6 August 2024

Understanding the advantages of the tax system in the USA

Navigating the tax landscape in the United States can be challenging, but numerous tax advantages are available to employers to help save money and promote business growth. This article provides a comprehensive overview of key benefits of the tax system that companies in the US can leverage to reduce costs and foster innovation.

Current income tax rates

In the US, income tax is progressive, meaning the more you earn, the higher the percentage of tax you pay. However, not all income is taxed equally; it falls into two different tax brackets. This is how the tax brackets work:

Taxable Income: After accounting for all deductions and tax credits, the remaining amount is your taxable income. This income falls into different tax brackets.

Progressive Rates: Higher income means higher tax rates. Each portion of your income is taxed at its corresponding bracket rate, not necessarily the rate of your highest bracket.

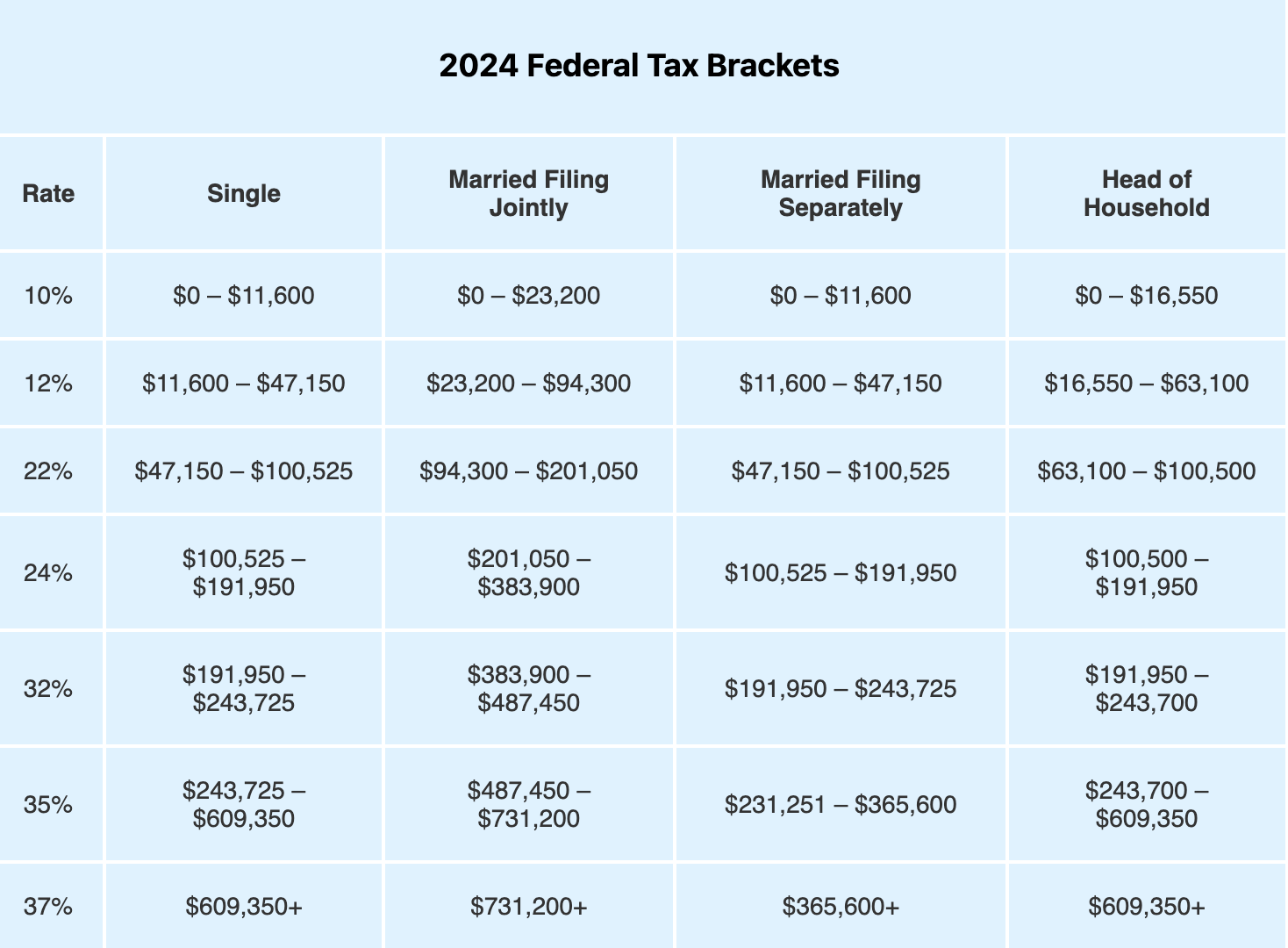

Your tax rate varies depending on the source and amount of your income. Only some of your income will be taxed at your highest tax bracket rate. The federal tax brackets are updated annually to account for inflation. In the table below, the different tax rates per bracket are shown:

Source: smartassests.com

Credits and deductions for employers

As an employer, understanding tax benefits in the US can provide substantial financial savings and foster business growth. Here is an in-depth overview of essential allowances and programs available to employers in the United States.

Work Opportunity Tax Credit (WOTC)

The Work Opportunity Tax Credit (WOTC) is a federal tax credit designed to incentivise employers to hire individuals from specific target groups with significant employment barriers. Administered jointly by the IRS and the Department of Labor, the WOTC is available for wages paid to eligible employees who begin work before December 31, 2025. Employers can claim a credit of 40% of up to $6,000 in wages paid to these employees during their first year, provided they work at least 400 hours. This translates to a maximum credit of $2,400 per eligible employee. For certain qualified veterans, the wage limit can be as high as $24,000, potentially yielding a credit of up to $9,600. Employers can carry unused WOTC credits back one year or forward for up to 20 years.

Federal Insurance Contributions Act (FICA) Tip Credit

The FICA Tip Credit is available to employers in the food and beverage industry. It allows them to claim a tax credit for the employer’s portion of Social Security and Medicare taxes paid on employee tips. This credit encourages accurate tip income reporting and financially relieves employers who must pay FICA taxes on these earnings. Notably, the credit calculation uses a frozen minimum wage rate of $5.15 per hour rather than the current federal minimum wage of $7.25, resulting in a higher credit for employers.

Research and Development (R&D) Tax Credit

Businesses investing in research and development can benefit from the R&D Tax Credit, which offsets federal income taxes and promotes innovation and technological advancement. This credit applies to various expenses, including wages for employees engaged in R&D activities, costs of supplies used in research, and expenses related to developing prototypes. By claiming this credit, businesses can significantly reduce their tax liability, making it easier to fund ongoing innovation efforts.

Section 179 Deduction

Section 179 Deduction allows businesses to deduct the total purchase price of qualifying equipment and software purchased or financed during the tax year rather than depreciating these assets over several years. This immediate expense can lead to substantial tax savings and improve cash flow, enabling businesses to reinvest in their operations more quickly. For 2024, the maximum amount that can be deducted is $1,160,000, with a phase-out threshold of $2,890,000.

Small Business Health Care Tax Credit

Small employers providing health care coverage to their employees can benefit from the Small Business Health Care Tax Credit. This credit offers up to 50% of the premiums paid for employee health insurance (35% for non-profit employers). To qualify, businesses must have fewer than 25 full-time equivalent employees, pay average annual wages of less than $56,000, cover at least 50% of health insurance premiums, and offer coverage through the Small Business Health Options Program (SHOP).

Empowerment Zone Employment Credit (form 8844)

Businesses in designated empowerment zones can claim the Empowerment Zone Employment Credit for hiring employees who live and work in these economically distressed areas. This credit aims to stimulate economic growth and employment in disadvantaged communities by offering a credit of up to $3,000 per eligible employee. Businesses must file Form 8844 with their tax return to claim this credit.

Maximize the advantages of the tax system in the US: the benefits of partnering with an Employer of Record (EOR)

Navigating the US tax system can provide significant financial benefits for employers, helping businesses save money, invest in growth, and maintain a competitive edge. However, compliance with all the regulations can be complex. That’s where a specialized Employer of Record in the USA comes in. An EOR handles payroll and taxes, ensuring you comply with local laws and regulations and helps you maximize the tax benefits you’re entitled to, allowing you to focus on growing your business.

The US offers a range of tax advantages, from credits that encourage hiring and innovation to deductions that reduce taxable income. Opportunities like the Work Opportunity Tax Credit (WOTC), FICA Tip Credit, and Empowerment Zone Employment Credit can significantly boost your bottom line. With the assistance of American Employer of Record, you can navigate these opportunities smoothly and efficiently, ensuring compliance and optimal financial health for your business. Partnering with American Employer of Record can provide peace of mind and operational efficiency, allowing your business to thrive. Contact us today!